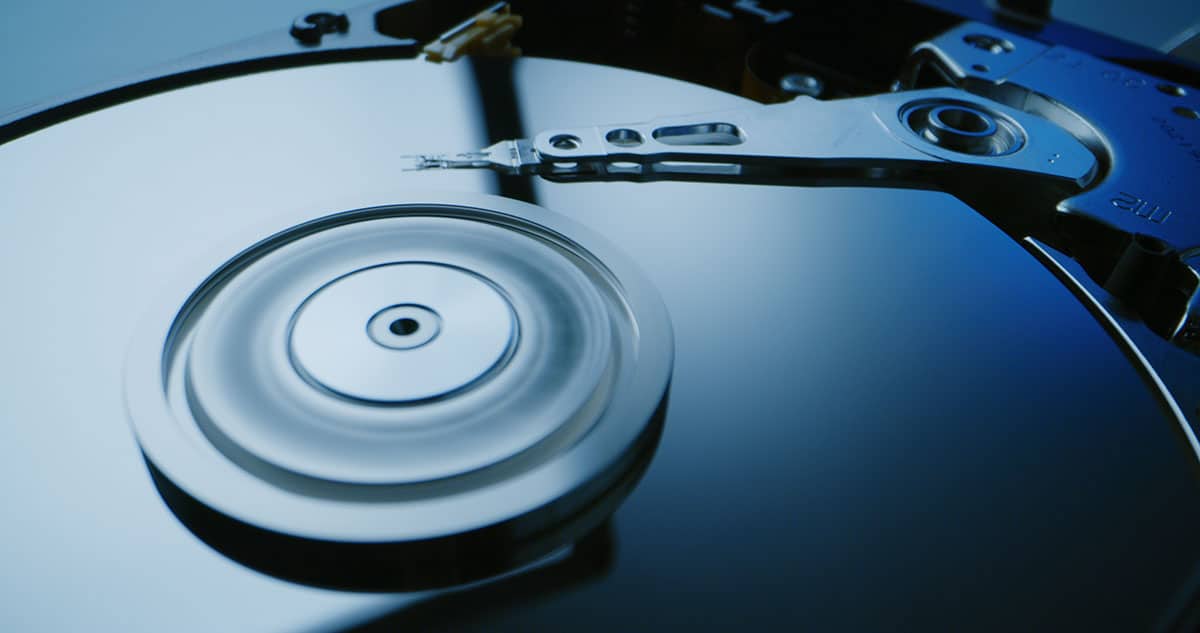

You’ve got to respect the endurance of the hard disk drive data storage device, first introduced by IBM in 1953 for commercial use before becoming the crucial technology for accommodating ever-expanding data stores accumulating on commercial and personal computer. Despite its imperfections (“click of death” anyone?) the HDD and its ability to quickly store and retrieve digital information using rapidly rotating disks (platters) has defined storage technology for more than 50 years. Is it possible the HDD resurgence happens in the near future?

HDD and the rise of Solid State Drive

Today, storage technology has taken to the cloud, SSDs and other younger, smaller, faster data storage solutions. As a result, hard disk drive shipments began to steadily decline between 2011 and 2012. But the HDD may be on the verge of a rebirth according to storage technology pioneer Tom Coughlin (Coughlin Associates.) In a recently posted edition of Digital Storage Technology Newsletter, Coughlin (DSTN editor) predicts a modest HDD resurgence in 2015, following steadily declining shipments in 2013 and 2014. After all, you can’t begin a resurrection until you’ve hit rock bottom, which is precisely what Coughlin foresees will be the course hard disk drive shipments take in 2014.

Coughlin bases his predictions on HDD shipment reports from calendar Q4 2013 laid out with projections for 2014 and beyond, and it’s the ever-growing volume of digital information that needs storing today and will need storing tomorrow that makes us want to keep tried and true storage technology around.

Other telling information on HDD storage shipments have been compiled by Coughlin as follows:

(courtesy Digital Storage Technology Newsletter):

- Total hard disk drive shipments in CQ4 2013 were up about 1.8 percent from the previous quarter (140.2 M units.)

- Notebook HDD shipments were down 2.0 percent, while desktop HDD shipments were up 1.1 percent.

- Consumer Electronics hard disk drive shipments were up 6.9 percent while branded shipments were up 12.8 percent.

- High performance enterprise storage was down 2.3 percent while enterprise near line and capacity hard disk drives showed growth at 0.6 percent quarter to quarter (slightly higher growth than the prior quarter.)

- 1.8 inch HDDs were flat from the prior quarter (flat with CQ1,) while 3.5-inch HDDs increased by 4.9 percent and 2.5-inch hard disk drives declined by about 1.3 percent.

- The growth in 3.5 inch drives against the decline in 2.5-inch drives is reversing a long-term trend towards smaller form factor HDDs.This change will likely continue until there is a recovery in mobile computers with hard disk drives.

- Total HDD shipments in 2013 were 552 M units, down about 4.3 percent from 2012.

- Comparing 2013 to 2012, Traditional Enterprise hard disk drives declined 21.1 percent, while Nearline and Capacity Enterprise increased by 47.5 percent. Desktop drive shipments declined 7.4 percent, CE gained by 10.6 percent and notebook HDDs declined by 15.6 percent.

- WD projected a March quarter (CQ1 2014) TAM of 131-135 M units while Seagate had a wiser range with a TAM estimate of 130-145 M units. Our estimate for total HDDs shipped in 2014 is 544 M units.

- Hard disk drive prices were up slightly, about 0.9 percent, in CQ4 2013 vs. CQ3 2013. HDD prices are still significantly above where they were before the late 2011 floods despite reduced shipments, indicating that HDD companies are keeping good control of their inventories and thus their ASPs.

- There are major campaigns underway by all three HDD companies—Western Digital, Seagate and Toshiba— to produce hybrid HDDs with some flash memory. In 2013, Seagate announced they had shipped more than one million hybrid HDDs. The latest generation of solid state drive products includes up to 16 GB of flash memory, but future products could pack more than >20 GB of flash memory.

- HGST, a WD company, announced that they were shipping a 6 TB, 7-disk sealed HDD filled with He for near-line or cold storage applications.

- Seagate and the other hard disk drive companies are shipping shingled magnetic recording (SMR) hard disk drives this year that could provide even higher storage capacities.

- We believe that a projected decline of about 1.5 percent this year appears likely, but it is possible that there could be positive growth in 2014.

- There is an opportunity for positive growth in hard disk drive shipments in 2015 and 2016 if trends for near-line, capacity enterprise and branded product HDDs show similar growth trends compared to 2013, and if PC HDD sales stabilize. We are currently projecting Year Over Year growth of 3.6 percent unit shipment growth in 2015.

We expect computer sales to stabilize, which will also contribute to hard disk drive growth by 2015. As Coughlin explains, a chunk of expected total stored capacity growth of at least 30 percent annually will most likely be storage on HDDs. As the efficiency of data center storage upgrades approaches overload, total hard disk drive demand should increase provided they can remain competitive price-wise. What does this mean? More need for hard drive data recovery services.